Peter Thompson QC explains why UK taxpayers deserve an amnesty

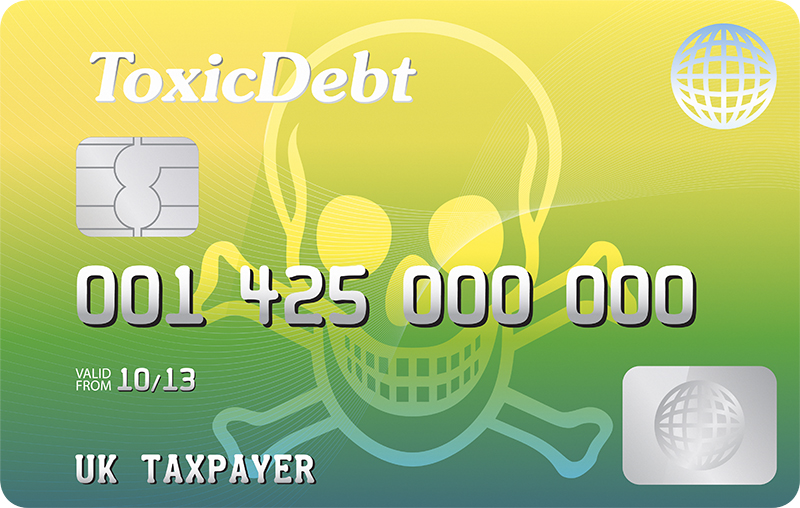

The conventional wisdom is that in 2008 the Western economy was rocked and almost brought down by toxic assets in the stream of commerce. The classic example of a toxic asset is the sub-prime mortgage, but no less toxic is the sub-prime loan in the form of unsecured loan facilities provided by credit cards. According to Credit Action, in the UK the total sum of individual debt, secured and unsecured, rose from £1,100bn in 2005 to £1,425bn in 2008, which is roughly where it is today. Assuming, for the sake of what follows, that the increase between 2005 to 2008 was caused by the addition of seriously toxic business, we are looking at a toxic lake of about £325bn.

As wise economists have observed, although in most cases after the event, financial institutions should beware of putting toxic products on the market: the whole banking system is thereby put at risk of being poisoned. By 2008 it had become very sick indeed. Happily UK taxpayers (many of them toxic debtors) came