What constitutes a fair public consultation following the Moseley judgment, asks Andrew Eaton

In the current climate of public sector austerity, public bodies regularly need to take difficult decisions to go further with fewer resources. In this context, the way in which public bodies make those decisions is coming under increased scrutiny, particularly in relation to tax and welfare.

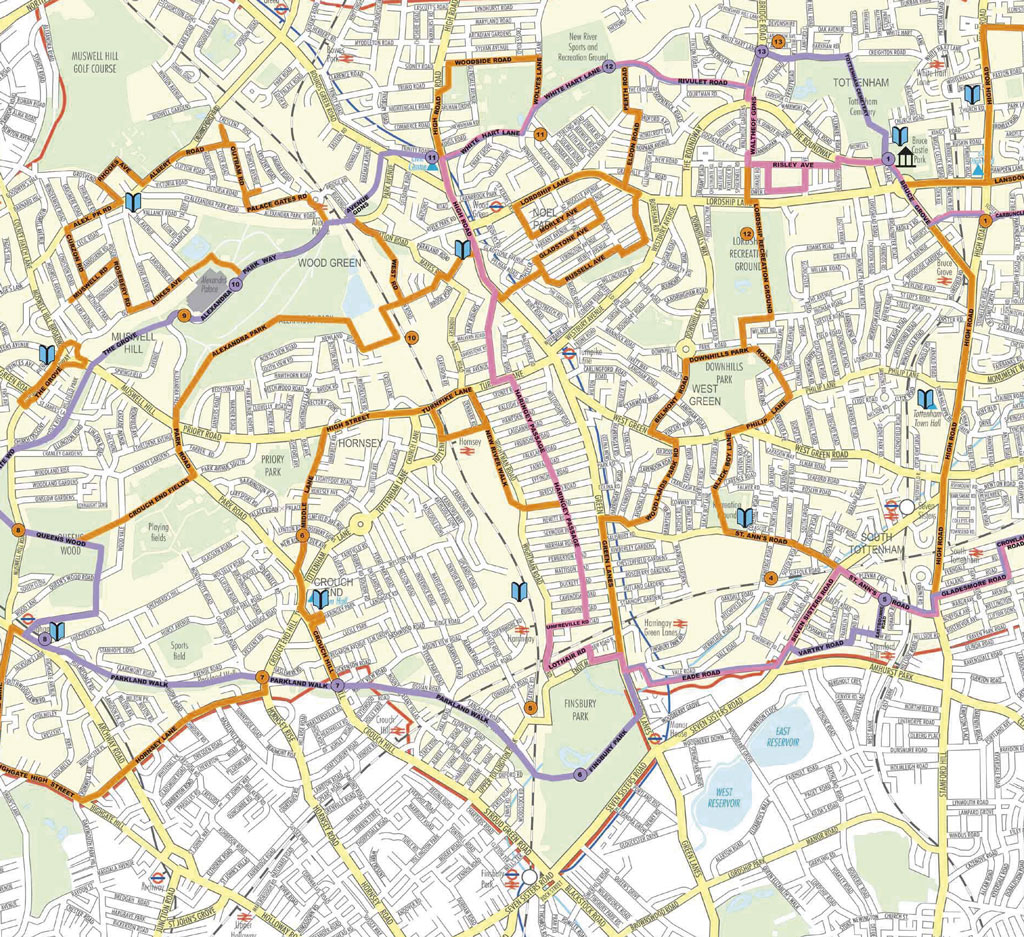

The Supreme Court has provided guidance on how to conduct a fair public consultation process in R (on the application of Moseley) v London Borough of Haringey [2014] UKSC 56. Moseley is the first time that the UK’s highest court has considered the law on the duty to consult.

Background

As part of its wider public spending reduction agenda, the coalition government resolved in 2012 to abolish the national mechanism by which council tax benefits (CTB) were provided. Under a new regime, local authorities were required to design and operate replacement local schemes, known as council tax reduction schemes (CTRS).

The Local Government Finance Act 2012 introduced a requirement that local authorities publish and consult interested persons on a draft CTRS. In late 2012,